Surveillance is power, as authoritarian regimes across history have known. The emergence of the internet in the late-20th century made surveillance easier than ever, by creating a historically unprecedented repository of information about individuals and organizations stored on servers throughout the world.

Over the years the dangers of the internet’s Panopticon have pushed many ordinary people to fight back – advocating for regulation via their governments where possible, but also by developing their own technological defenses, including popular tools like encrypted email and messaging platforms. It is no exaggeration to say that, without privacy, individual freedoms cannot long survive. And the battle for privacy in the digital age is now headed to its newest, and perhaps most consequential stage, with the emergence of central bank digital Currencies, or CBDCs.

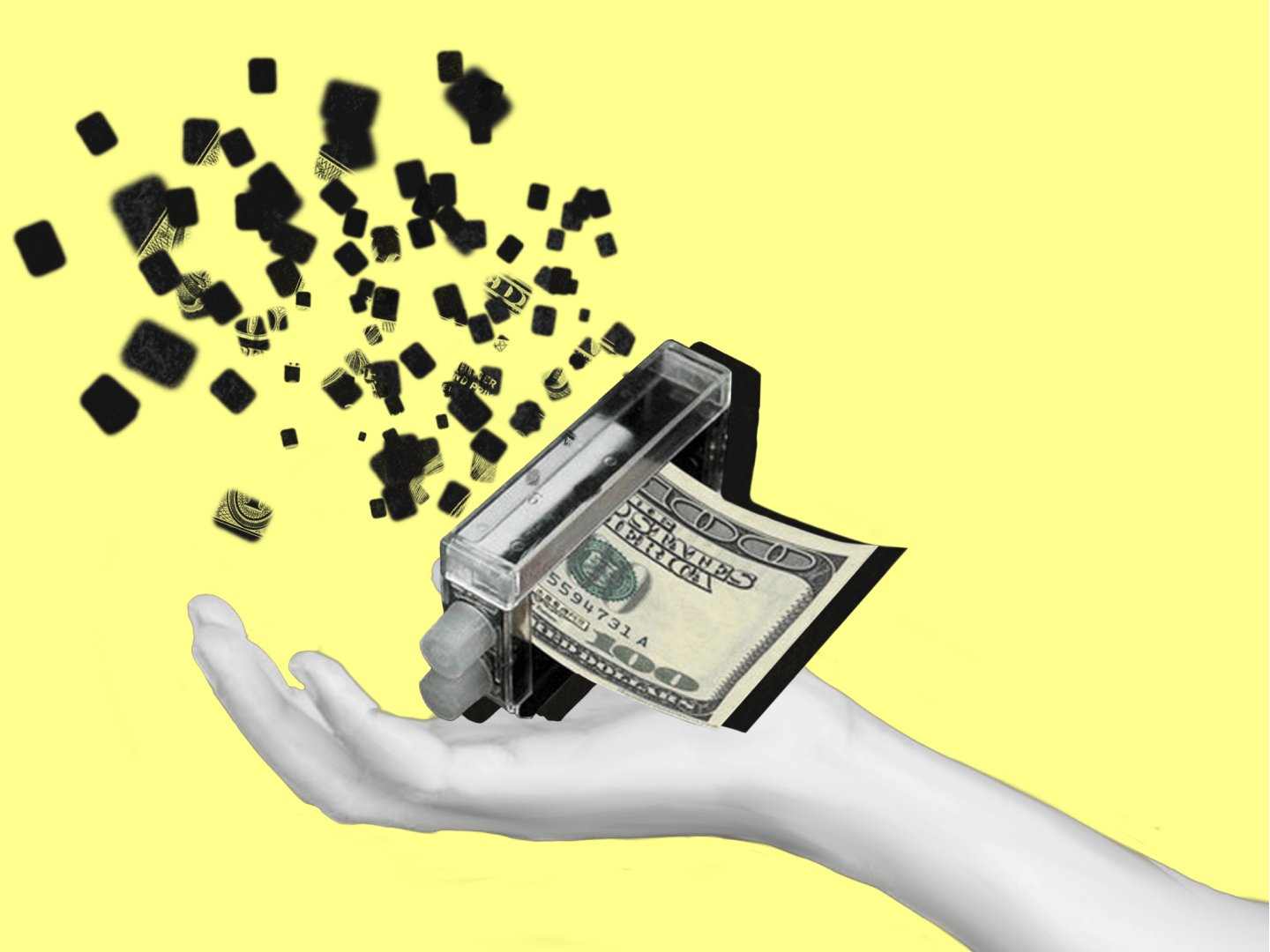

CBDCs are central government’s attempts to turn blockchain technology to its own use: utilizing its efficiencies for storing and transferring value, but also through the social control via surveillance that it makes possible. CBDCs have clear benefits over the analog financial system, but alongside the promise of increased financial access and efficiency, they also expose citizens to a level of potential surveillance inconceivable in the past.

Mots-clés : cybersécurité, sécurité informatique, protection des données, menaces cybernétiques, veille cyber, analyse de vulnérabilités, sécurité des réseaux, cyberattaques, conformité RGPD, NIS2, DORA, PCIDSS, DEVSECOPS, eSANTE, intelligence artificielle, IA en cybersécurité, apprentissage automatique, deep learning, algorithmes de sécurité, détection des anomalies, systèmes intelligents, automatisation de la sécurité, IA pour la prévention des cyberattaques.