Having to retool financial marketing on the fly due to fast-changing economic trends is challenging for all financial institutions. Bank and credit union marketers reveal their thinking and tactics, along with some examples of ads.

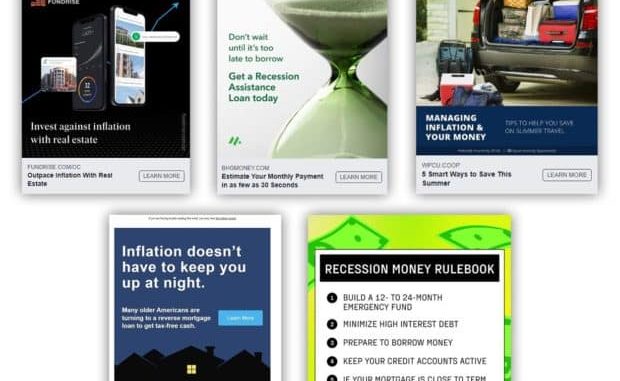

Rising interest rates, the return of high inflation, and the continuing potential for a recession have banks and credit unions reexamining their marketing as they adapt to a new and fast-moving environment.

It wasn’t that long ago when an even greater challenge — the sudden arrival of Covid in early 2020 forced financial marketers to learn agility under pressure. With the pandemic, product marketing pretty much got paused while institutions concentrated on telling people how to continue banking during branch shutdowns and how to obtain Paycheck Protection Program loans.

This time around the demands are quite different. There’s a need both to talk to the situation — very different from what many consumers and businesses have seen for years — but also the need to shift gears in terms of what products to promote and how.

The Financial Brand sought input directly from bank and credit union marketers about how they’re reacting as well as from experts at Mintel regarding financial institution marketing trends they are seeing.