View the high resolution version of this infographic. Buy the poster.

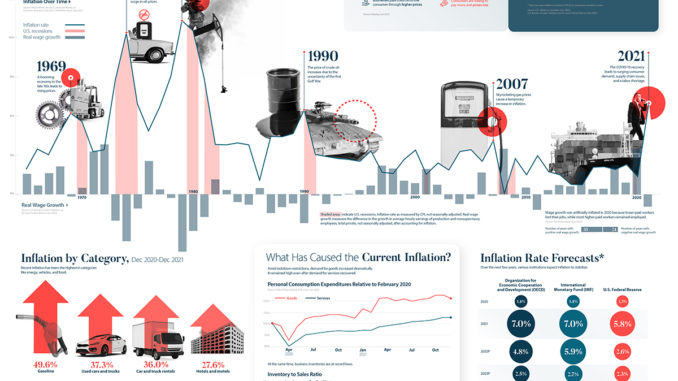

The inflation rate in the U.S. has surged, reaching 7% year-over-year in December 2021. This marks the highest level in 40 years.

In this graphic from New York Life Investments, we look back at historical inflation—and where experts think it may be headed next.

Before we dive into the data, let’s take a look at what inflation means. Inflation measures how quickly the prices of goods and services are rising. Moderate price growth is generally a sign of a healthy economy. As the economy grows, consumer demand increases and prices go up.

There are two types of inflation.

- Cost-push inflation: Production costs, such as materials and wages, increase. Supply declines due to higher costs, and businesses pass costs on to the consumer through higher prices.

- Demand-pull inflation: Consumer demand surges. Supply declines due to higher demand, which means consumers are willing to pay more and prices rise.

We are currently experiencing both cost-push inflation and demand-pull inflation. This is different from the other inflationary periods over the past 50 years, where rising energy prices led to cost-push inflation. We measured inflation using data from the Consumer Price Index, which measures the change in price that urban consumers pay for a basket of goods and services. The data shows the year-over-year change from December of the prior year and is not seasonally adjusted.