The banking industry has been shaken up by blockchain technology, which has changed how money is transacted. In this article, we’ll talk about the advantages, difficulties, and potential uses of blockchain technology in financial transactions.

How Does Blockchain Technology Work?

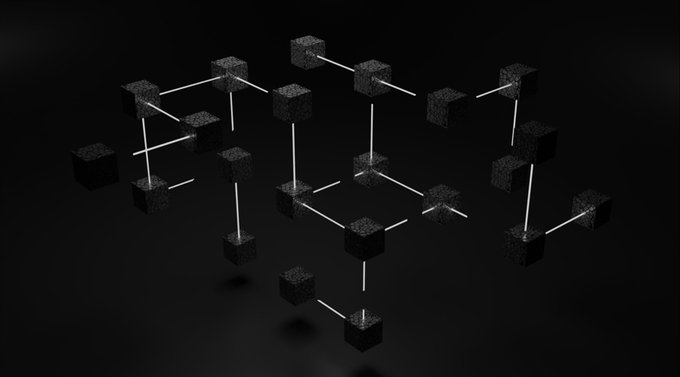

Blockchain technology is fundamentally a decentralized digital ledger that securely and openly records transactions on numerous machines. Every transaction is documented in a block, which is subsequently added to the chain of blocks (thus, ‘blockchain’), one block for each transaction.

It is impossible to change or remove a block once it has been added to the chain, making it a safe and impenetrable record of all transactions.

Blockchain Technology’s Benefits for Financial Transactions

The capacity of blockchain technology to lower costs and increase efficiency in financial transactions is one of its key advantages. In traditional financial transactions, there are frequently several middlemen who each charge a fee for their services. With the help of blockchain technology, transactions may be carried out directly between participants, doing away with the need for middlemen and cutting down on transaction fees.

Mots-clés : cybersécurité, sécurité informatique, protection des données, menaces cybernétiques, veille cyber, analyse de vulnérabilités, sécurité des réseaux, cyberattaques, conformité RGPD, NIS2, DORA, PCIDSS, DEVSECOPS, eSANTE, intelligence artificielle, IA en cybersécurité, apprentissage automatique, deep learning, algorithmes de sécurité, détection des anomalies, systèmes intelligents, automatisation de la sécurité, IA pour la prévention des cyberattaques.