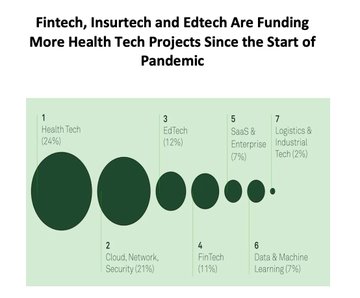

Financial technology [fintech], insurance technology [insurtech] and education technology [edtech] are disrupting mental healthcare.

There are now several startups and platforms that are extending mental healthcare, across the world.

Being in debt is now normalised by governments’ trillion-dollar debt burdens and the rise of ‘have it now’ products and services. Mortgages, credit cards, car payments and more recently buy-now-pay-later are putting pressure on millions of people struggling with mental health to get more debt.

The truth is, being in debt brings with it a huge mental burden that can become so heavy that it is fatal.

Mots-clés : cybersécurité, sécurité informatique, protection des données, menaces cybernétiques, veille cyber, analyse de vulnérabilités, sécurité des réseaux, cyberattaques, conformité RGPD, NIS2, DORA, PCIDSS, DEVSECOPS, eSANTE, intelligence artificielle, IA en cybersécurité, apprentissage automatique, deep learning, algorithmes de sécurité, détection des anomalies, systèmes intelligents, automatisation de la sécurité, IA pour la prévention des cyberattaques.