Greetings from Austin, Texas, where the temps have been over 100 degrees for days now and we’re trying hard just not to melt.

The global funding boom in 2021 was unlike anything most of us have ever seen before. While countries all over the world saw surges in venture capital investments, Latin America in particular saw a massive bump in dollars invested. Unsurprisingly — with so many people in the region being underbanked or unbanked and digital penetration finally taking off — fintech startups were among the largest recipients of that capital.

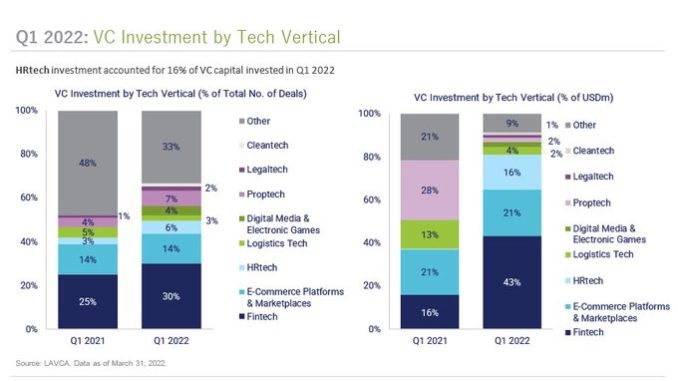

Notably, fintech startups were by far the largest recipients of venture capital funding in the 2022 first quarter, with 43% of dollars raised — or $1.2 billion – having flowed into the category. That’s up from 16% in the first quarter of 2021. Meanwhile, investments into fintechs made up 30% of all deals in the second quarter, compared to 25% in Q1 2021.