The Asia Pacific region is leading the way in a revolution that is changing the way consumers interact with financial services.

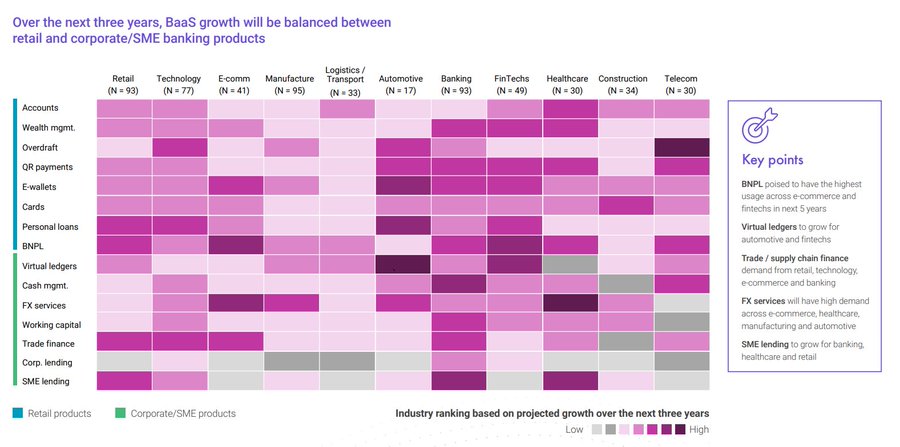

Banking as a Service (BaaS) has been spreading rapidly over the last couple of years, enabling brands to offer their customers a range of financial services, from buy-now-pay-later financing to personalised and proactive lending offers.

In fact, new research from Finastra reveals that 88% of senior executives in a number of sectors (including banking, healthcare, retail and technology) said they are already implementing BaaS solutions or are planning to, compared with 80% in EMEA and 87% in the Americas.

BaaS is the provision of retail or wholesale banking products and services, in context, as a service using an existing licensed institution’s secure, regulated infrastructure with modern API-driven platforms.

Mots-clés : cybersécurité, sécurité informatique, protection des données, menaces cybernétiques, veille cyber, analyse de vulnérabilités, sécurité des réseaux, cyberattaques, conformité RGPD, NIS2, DORA, PCIDSS, DEVSECOPS, eSANTE, intelligence artificielle, IA en cybersécurité, apprentissage automatique, deep learning, algorithmes de sécurité, détection des anomalies, systèmes intelligents, automatisation de la sécurité, IA pour la prévention des cyberattaques.